The end of the year is coming and the beginning of the 1099 filing season. In this post, we’ll go over the general elements you’ll need to review for Form 1099 NEC in AppFolio.

Make Sure you have all the information needed.

Whether you generate 1099s through AppFolio or using another software, you need to ensure you have complete and accurate information.

One of the reports you can review to ensure you have all your vendor’s tax IDs is the Vendor 1099 Summary report. In this report, you’ll see which vendor with the Send 1099 option is missing the Tax ID. The Federal Tax ID comes from the Vendor’s Page in the Federal Tax section, where you’ll set up the information provided by the vendor’s W-9 form.

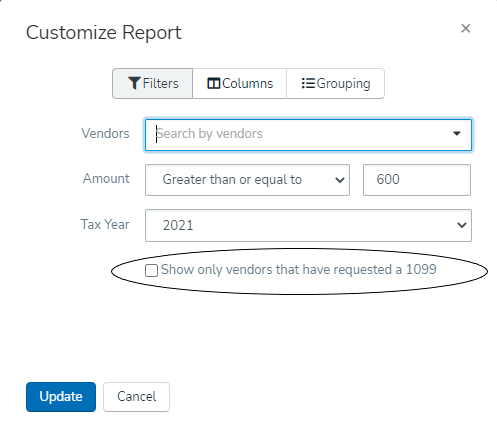

You can customize this report using different filters, even setting up the amount to be greater or equal to $600, which is the threshold as of today’s date for form 1099-NEC.

Also, you can review the Vendor 1099 Detail report. Here, you’ll need to choose a specific vendor to see all the transactions included for their 1099 total.

Get W-9 Forms

Once you have all the vendors with missing information, make sure to reach out to them and collect their respective W-9 forms. We strongly recommend that business owners collect W-9 forms from vendors/contractors before paying for services. It becomes more difficult to collect these forms when the service has been provided, especially one-timers.

We recommend you double-check the Vendors who don’t have the Send 1099 option checked off on the vendor’s page, just in case you’re missing vendors from whom you should collect their W-9 form. You can do this from the Vendor 1099 Summary report just by unchecking the box that shows “Only vendors that have requested 1099”; this will allow you to see all vendors.

Include all transactions as of December 31st

Before you start preparing 1099s, make sure your books are up to date, so the totals that need to be reported are correct.

You also need to ensure that your chart of accounts is set up correctly. By generating the Chart of Accounts report, you can check which accounts are checked as Exempt from 1099 and edit them accordingly.

Once you are sure you have all the information, you can start preparing and sending your 1099s.

We hope you’ll have a successful filing season in 2022. The key is to start as soon as possible. If you have questions about this topic, do not hesitate to Contact Us