When starting the journey in AppFolio, bank reconciliations are likely on your checklist. Reconciling your bank accounts is very important. You want to make sure your internal records match what’s happening in real life. By doing so, you can be aware of any unusual transactions, accounting errors, and even spot inefficiencies in the business, making your financial reports more accurate.

Let’s get to the main reason some people get stuck in the process when reconciling: The Triple Tie Out.

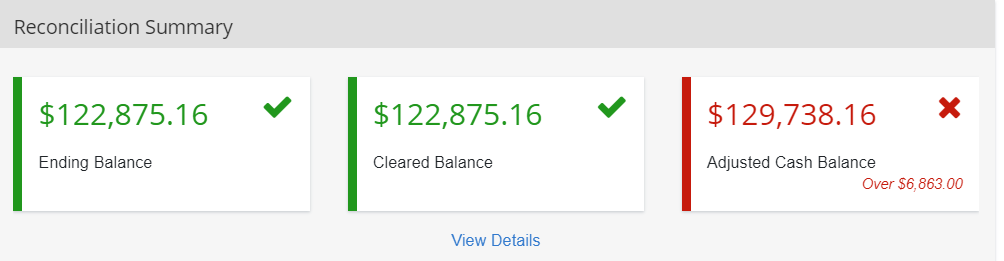

Once in the AppFolio reconciliation screen, the Adjusted Cash Balance can be somewhat of an issue for some people since it represents what AppFolio thinks you should have in your bank account. To fix any mismatches, you must locate the transactions throwing off balance. A lot of time can be spent trying to figure out what’s happening. We have some tips that can help you avoid this issue and make your monthly AppFolio reconciliations run as smooth as possible:

1. Look at the beginning balance in your reconciliation screen. It should be the same as the bank statement you’re trying to match.

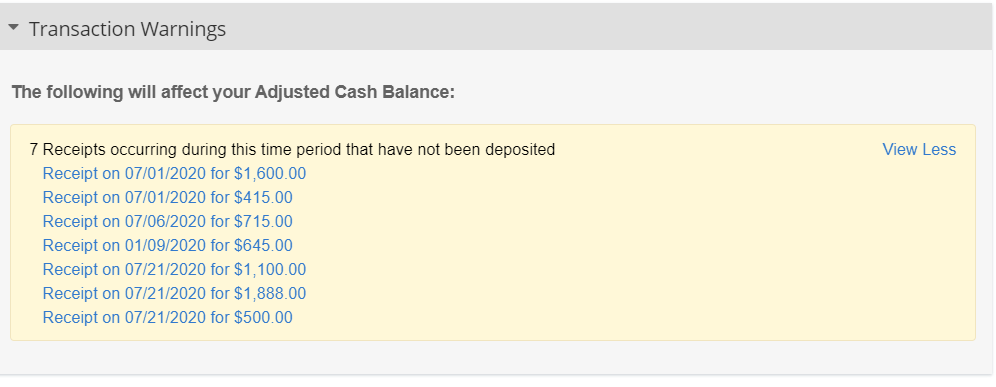

2. Make sure all your receipts are deposited: When creating new tenant’s receipts, ensure your deposit date is the same as the one shown in your bank deposit slip. When you have any undeposited receipts, they’ll show on your Transaction Warnings in your reconciliation screen like the example below. If you don’t have a deposit for them, you can change the date of the receipts so they are not considered for the current reconciliation period.

3. Try not to reconcile transactions manually, and if you do, make sure the net effect is zero: Sometimes, it’s necessary to record transactions that happened in the past, but more often than not, these transactions never made it to your current bank account. We recommend making sure you are debiting and crediting your cash account; for example, if you created an entry debiting the cash account and reconciled it manually, make sure you take these funds out by crediting it won’t have any effect on your current reconciliation.

4. Match your Deposit and Payments to your bank statement: This seems pretty basic, but if you have a lot of transactions you need to check off, you might have missed some of them. Most bank statements disclose the total deposits and payments during the period, so why not use all the tools available to us.

5. Use the search bar in the reconciliation screen: As mentioned, sometimes you can have too many transactions that you might get confused, so it’s always helpful to search amounts with this feature.

6. Make your transactions identifiable: When recording information affecting your bank account, make sure you type all references and descriptions accurately since this will show in your reconciliation. This comes in handy when you have a lot of transactions for the same amount and on the same date; some might have cleared and others might not; you want to make sure you’re clearing the right one.

Whenever in doubt, you can reach out to an AppFolio accounting expert to help you set the foundations for clean and accurate bookkeeping. If you have questions about this topic, do not hesitate to Contact Us